A distributed blockchain is a shared record that is stored in many different locations which cannot be changed unless a majority of all the locations storing the record agree that a change is justified. But what does that mean? In this guide, we’re going to walk you through why trust is a must, what a blockchain is, why the technology is so important, how it works, and what the future holds.

Before we dive into what blockchains do and how they work, let’s get a little background for context.

Why Is Trust So Essential For Human Progress?

Trust is fundamental to the basic functioning of a society. Without systems of trust, we would be unable to open a line of credit, vote, hire a plumber, use services like Airbnb, call the police, or buy a sandwich.

Human trust systems have had four major evolutions since we started forming societies and striving for more complex levels of cooperation. Each trust system has been built on the last and even the oldest iteration is still in use today.

The Four Types Of Trust Systems

Trusted Third Parties

It was tough to know who to trust before the invention of things like writing and record keeping. How could you tell if somebody would keep an agreement if all you had to go on was your gut and a handshake?

The only way you could trust somebody in ancient times was if somebody you trusted said they were worthy of your trust. This third person is known as a "trusted third party" and serves the purpose of validating that someone can be trusted as well as verifying that a transaction has taken place.

Example:

Someone in your ancient village asks if you could let them borrow your cart for the day so they could pick some apples. In exchange, they offer to let you have some of the apples that they collect.

You don’t know this person, so how do you know if they will make good on their promise? How do you know they won’t just steal your cart?

Luckily, your neighbor, a trusted third party, overhears the conversation. He says that they let the same person borrow a fishing rod last week and they brought it back and gave him some of the fish they caught just like they said they would. He adds that he has witnessed the transaction and will help you get the cart back if the man steals it. Now you know you can trust this person and the transaction can take place.

The problem with this system is scalability. Systems of trust built on direct relationships limit the transactions you can make to a network of people that are within your social circle. Trade with other villages is impossible, because how can you know if the people over there can be trusted?

Written Law and Governments

Laws and central government take the burden of trust out of the hands of direct social networks and put it into a document. The trusted third party becomes the law and the legal system. If the law says that people are not allowed to steal, and there is a system in place to punish them if they do, then it becomes much easier to trust each other.

With laws in place, you can feel more confident that the agreements you make will be honored. A third party is available for verification in the form of a court whenever there is a problem. If someone steals from you, and you can prove it, you can take them to court and demand to be repaid.

The invention of government and organized religions allowed humans to use legal systems to trust each other and cooperate in ways that were scalable. This allowed human society to develop rapidly and accomplish tasks that just wouldn’t be possible otherwise.

Money

If you’re in the USA, pull out any bill from your wallet and read what’s written on it. Everything about the bill has been designed to engender trust.

You’ll notice a banner on the top that reads “Federal Reserve Note” this ties the value of the bill to one of the largest and most trusted financial institutions in the world. If their name wasn’t enough, you’ll notice a disclaimer from the Federal Reserve Bank on the face of the bill that reads “This note is legal tender for all debts, public and private” just in case you still had doubts.

On the back of the bill, it becomes clear that the line of trust doesn’t stop with the Federal Reserve, you’ll see it reads “In God We Trust” putting the validity of this bill’s value in God’s hands. Who would question that? The answer is very few people.

Money is by far the most effective system for trust that we have ever developed. Here’s how it works:

- If you give me a dollar for a glass of lemonade that I made I can trust that if I go to the store, I can buy a soda with that dollar.

- The store clerk can trust that at the end of the week the employee that sold me the soda will accept that dollar as a part of his salary.

- The employee then trusts he can take that dollar and buy a glass of lemonade.

As long as everyone in the economic system agrees that the dollar holds a specific value, then trade can happen normally, and everyone gets to have their favorite drinks.

By making the bills difficult to counterfeit and making sure that their value is being vouched for by a large trustworthy organization like the federal reserve, then the system works remarkably well.

Verification And Accounting

For money to work in situations beyond small cash exchanges, you need to have systems of account that can verify who owns what and how much money is in everyone’s accounts. You can use a bill of sale to prove you legally own something, but you will need a trusted third party to keep track of everyone’s accounts.

In the money system, these third parties come in the form of banks and credit card companies. They keep track of how much money you make, have spent, and who you have paid. Banks verify that transactions have happened and are there to help when things don’t add up. The court system then backs the banks up if the problem still can’t be resolved. All of this leads to a remarkably reliable and trustworthy money system that works the vast majority of the time.

The main issue with this system is that it's slow and expensive to maintain. The fact that a third party has to check to make sure that every single digital transfer of money from one account to another is valid and actually happened is grossly inefficient. Sometimes, it can take weeks before an account is settled. While the money system works well, there is definitely room for improvement.

Blockchain Technology

So, how do you verify that a digital transaction occurred without relying on a trusted third party like a bank or a credit card company to keep track of it? The answer is, you guessed it, Blockchain Technology!

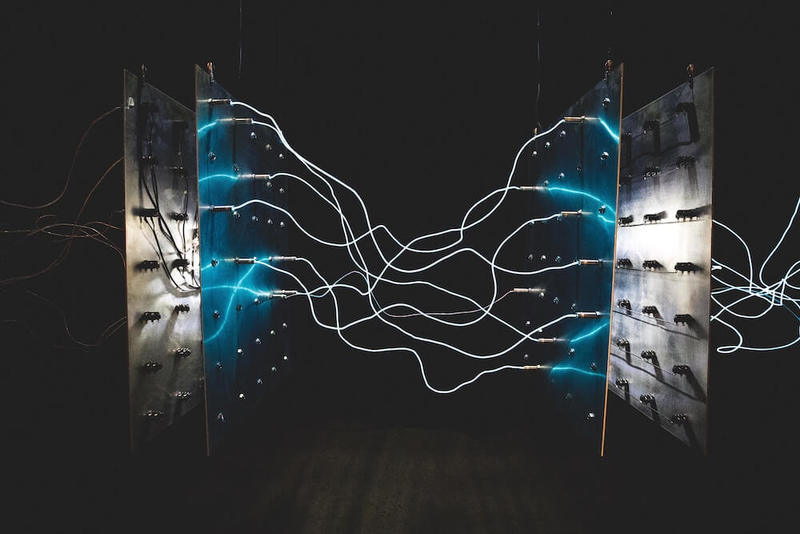

Using blockchains, transactions can be made and instantly verified across a network of interconnected nodes. Unauthorized changes cannot be made to one node without the others reconciling the problem. All nodes must agree for a transaction to take place.

Trust in the blockchain system is achieved through cryptography and advanced software protocols. On a blockchain network, transactions can occur between two parties, no banks or governments required. Without banks, the affordability and speed of transactions are increased dramatically while the requirements to participate in the system are significantly reduced.

The Components Of A Blockchain

While it’s true that the cryptographic details that make this system operate are complex, they can be broken down into three relatively easy to understand components.

Private Key Cryptography: Every user on a blockchain has two cryptographic keys, one public and one private. The public key is available for everyone to see and is used to identify an individual account, the private key is a secret key that nobody but you should see. Complex cryptography ensures that the only your private key can work with your public key.

When you combine a public key and a private key, it makes for a concrete “digital signature” if you will. Since nobody else knows your private key, if your public key is combined with the correct private key you must have initiated the transaction. In this scenario, cryptography and computer science fully replace the need for any other form identification (i.e you don’t need a driver’s license to prove your identity.)

P2P Distributed Network: While the private and public key system works great for identifying parties who are making transactions, you need a way to verify that a transaction actually happened.

A distributed network is when you store a database across many separate nodes and devices instead of one location. Blockchains use distributed networks as a security feature to ensure that a hack or failure in one part of the network won’t affect the overall functionality of the system as a whole. To this point, the more nodes in a network the more secure it becomes.

All the nodes communicate with each other, store information, and work to mathematically prove that transactions on the network have taken place and are valid.

Blockchain Protocol: When somebody wants to make a transaction, they post said transaction on the network, and all the independent nodes work to see if everything about the transaction makes sense and is valid.

You can think of a block in the chain as a puzzle piece that can only be created if all the criteria of the protocol are met and the mathematics are true. The protocol is like an equation and a new entry to the database cannot occur unless it is solved, checked, and validated by the network. If the majority of network nodes can reach consensus then, the transaction is time-stamped and a new block is created.

Primary Applications of Blockchain

Blockchain technology is a revolutionary way for humans to trust each other, by trusting technology. It is the first time where belief in a system is no longer necessary because the system can prove that transactions occurring on it are true. On the blockchain, it either happened, or it didn’t. The implications of the technology are profound, and so far we have seen it evolve into two primary applications: Cryptocurrencies and Smart Contracts.

Cryptocurrencies: When people think blockchain, usually the first thing that pops into their head is a cryptocurrency like Bitcoin. Cryptocurrencies are a direct replacement of the money system, but instead of putting their trust in institutions like banks, they put it in the blockchain.

With a cryptocurrency, if I want to make a transaction with you, all I need is money in my account, your public key, and my private key. No credit card company or bank is needed to keep a record of the transaction or verify it really is you making it, all of that work is handled by the blockchain network.

Beyond an improved system for trust and verification, cryptocurrencies function exactly the same as traditional currencies. You can buy things using cryptocurrency, their values are subject to changes in market conditions, and they can be traded on currency exchanges. The similarity between cryptocurrency and traditional currency makes the system relatively easy to adopt for businesses because they don’t have to fundamentally change their business models to start accepting crypto as payment.

Smart Contracts: While cryptocurrency is a very useful application of blockchain technology, it has its limitations. Smart contracts take blockchain technology and allow it to be applied to just about anything.

A smart contract is a digital agreement that once signed, becomes irreversible and self-enforcing. You don’t have to worry about taking somebody to court because the agreed-upon terms are executed automatically.

Example:

Let’s say someone creates an investment smart contract that states if a project gets $1M in crowd-sourced investment then it get started. If you invest in this project and it doesn’t reach its goal, then your funds would be released back into your account automatically.

When you think about it, every activity that human beings take part in can be translated and managed through a contractual agreement. Because of this fact, the possible applications of smart contracts are limitless.

What Does The Blockchain Future Look Like?

So, it’s obvious that blockchain technology will become a bigger and bigger part of our lives as time goes on, but what does this mean for us? Could we be moving towards a world where banks, governments, and court systems don’t need to be involved in the economy for it to function?

The short answer is probably not, but that doesn’t mean that blockchain technology won’t fundamentally change how we do business. The growing use and acceptance of cryptocurrencies will allow billions of new people to participate in the world economy who have never been able to before.

In the future, new projects will be much easier to fund through blockchain-based crowdsourcing and investment platforms. Easier access to capital will drive more business innovation than ever before in places of the world where it just wasn’t possible pre-blockchain. Voting will become more secure, medical records will become more useful, and environmental resources will become easier to conserve.

The promise that blockchain technology holds for the future prosperity of the human race is both exciting and inspiring. These systems have the potential to allow cooperation on a global scale that bypasses governments, banks, and legal systems. All you will need to participate in this new economy is a computer, some know-how, and a working internet connection.

What is a Dapp? Understanding Decentralized Applications

The Most Active Cryptocurrency Forums and How to Use Them

Stay in the know

Get special offers on the latest developments from Knowmatix.

Be the lucky user to earn $1000 bonus now!

Be the lucky user to earn $1000 bonus now!